B2B2C SaaS platform

Trusting AI advice is difficult for both financial advisers and their clients.

Anorak was a financial services startup selling life insurance and income protection, acquired by CLARK Group.

The platform was built around a proprietary engine using machine learning and data science to generate insurance advice regulated by the FCA.

The challenge was to help financial advisers and their clients sell the 'perfect' insurance recommendation.

Business KPI

Increase productivity

85%

Reduction from weeks to days for high-value cases

Role

At this early stage startup, I got to wear many hats

Leader

Anorak’s culture empowered me to take the lead on the product strategy, working closely with the product manager and engineering lead to shape the product.

Designer

Our small design team meant I could move faster, testing new interaction patterns and components to enhance workflows, and contributing to the design system.

Researcher

My preferred framework is Clay Christensen’s version of Jobs to Be Done (JTBD) to interpret the data into goals and needs of financial advisers and the clients they serve.

Product strategy

What does it mean to help advisers to be more productive?

We identified key opportunities to frame the direction of the platform's evolution.

Low product adoption

Advisers didn’t trust the AI advice because they were unable to explain it to their clients or customise it to their preferences.

Limited operational efficiency

Each financial adviser had their own way of working, which led to inefficiencies and lost opportunities. Sales managers had limited oversight of the team’s performance.

Low case progression

Clients with health conditions converted better, but were overlooked by advisers due to the amount of manual work involved. Also, advisers typically stuck to the products they were familiar with.

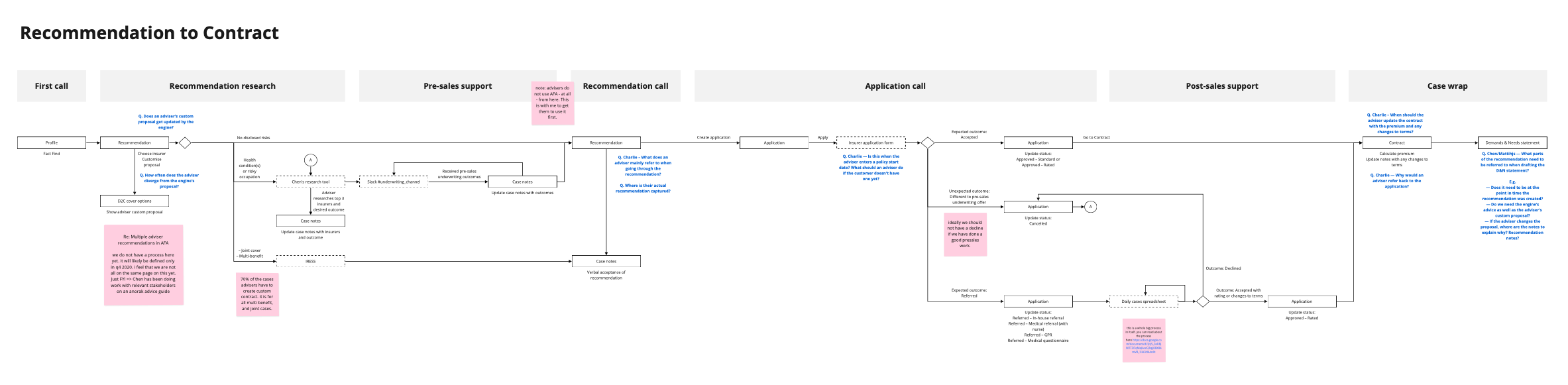

Product discovery

Sitting with and observing advisers to see how they work in the field

Contextual observation enabled me to see how advisers used (or didn't use) the platform.

Phone call analysis between the adviser and their client enabled me to understand how advisers used the platform to serve their clients in real-time.

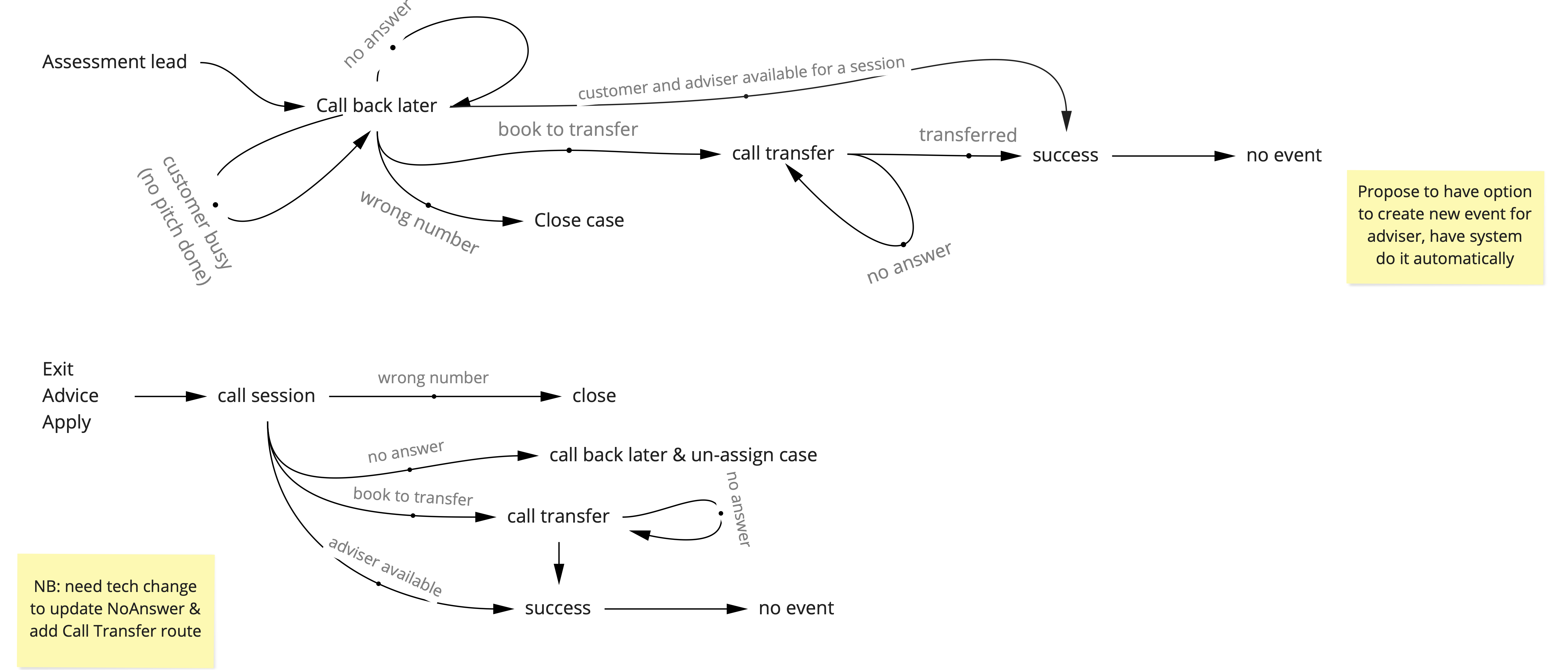

Mapping the adviser's workflow from making a recommendation to finalising the policy contract to ensure we designed for not just the most common use case, but also key edge cases.

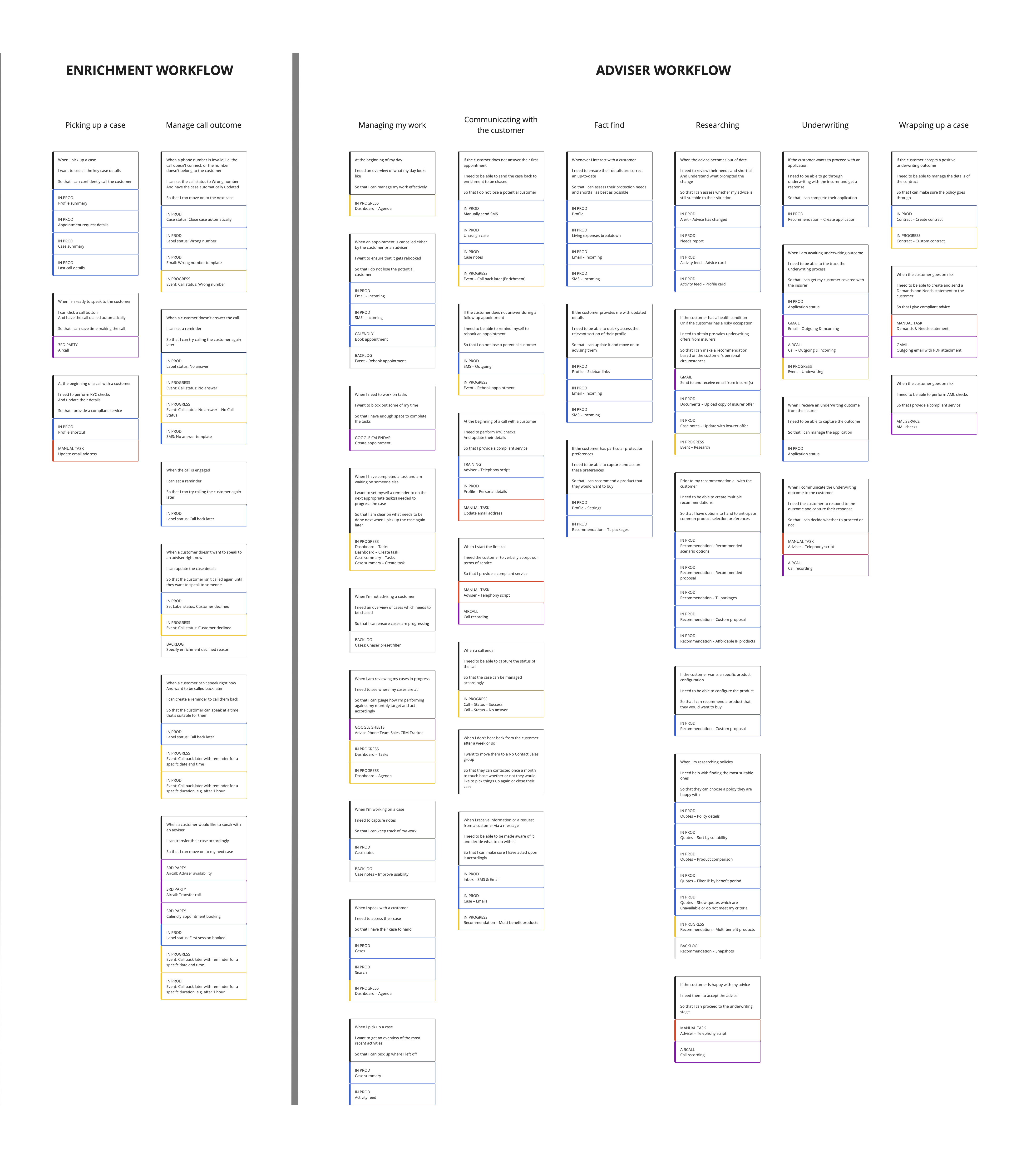

Mapping goals and tasks advisers needed to achieve those goals helped the team to make sure we were building the things which mattered most.

Systems design

Shaping the new platform architecture and defining business rules with the lead engineer

At the start, there's no point in jumping into wireframes because we don't even know what features the new platform is going to have.

My Computer Science degree came in handy here, as I was able to have conversations with the lead engineer about the new platform architecture.

Being able to shape the system's design from the beginning was vital to the success of the product as it allowed me to set better foundations for the product's design.

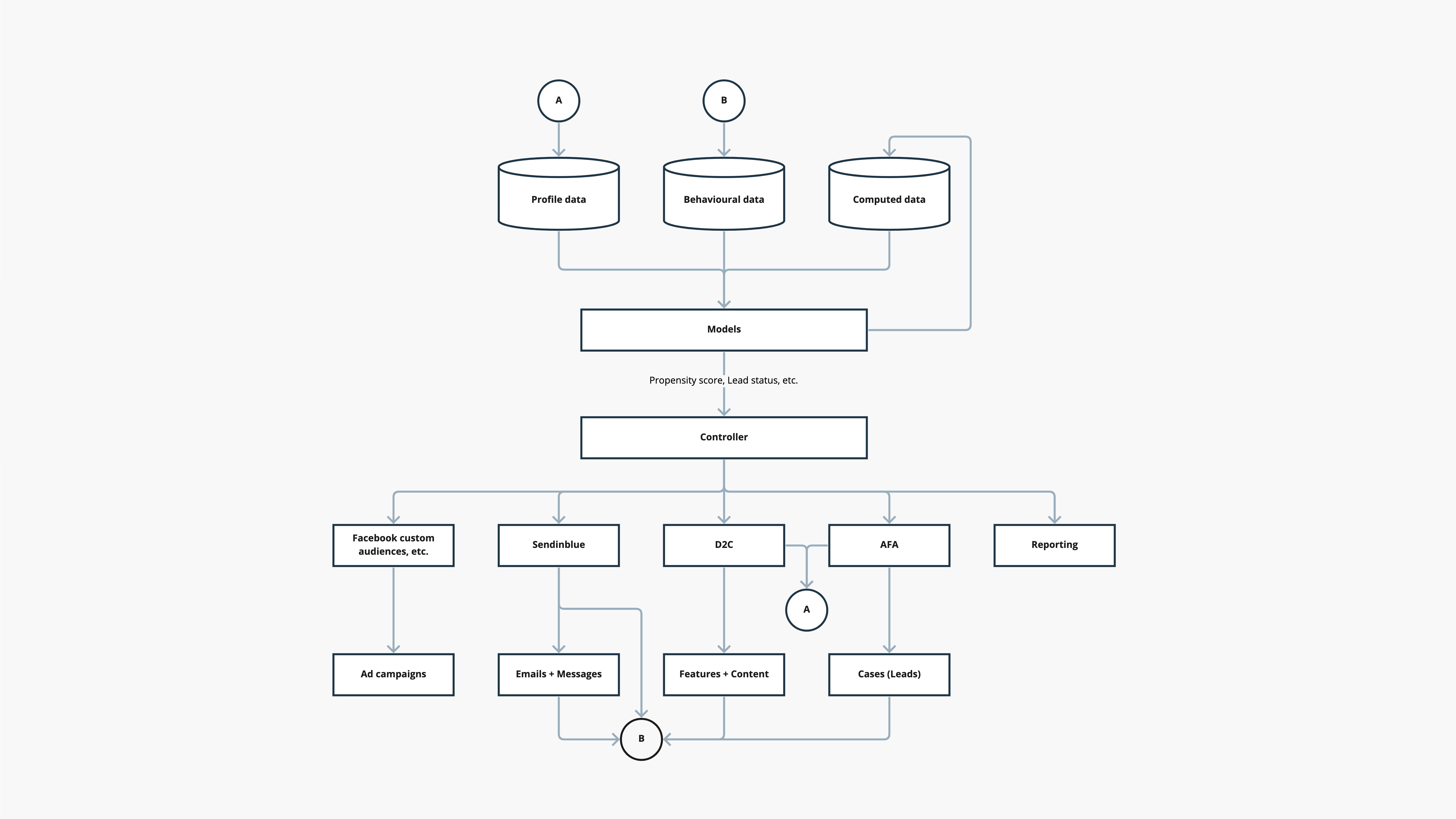

How the B2B product fit into the platform ecosystem.

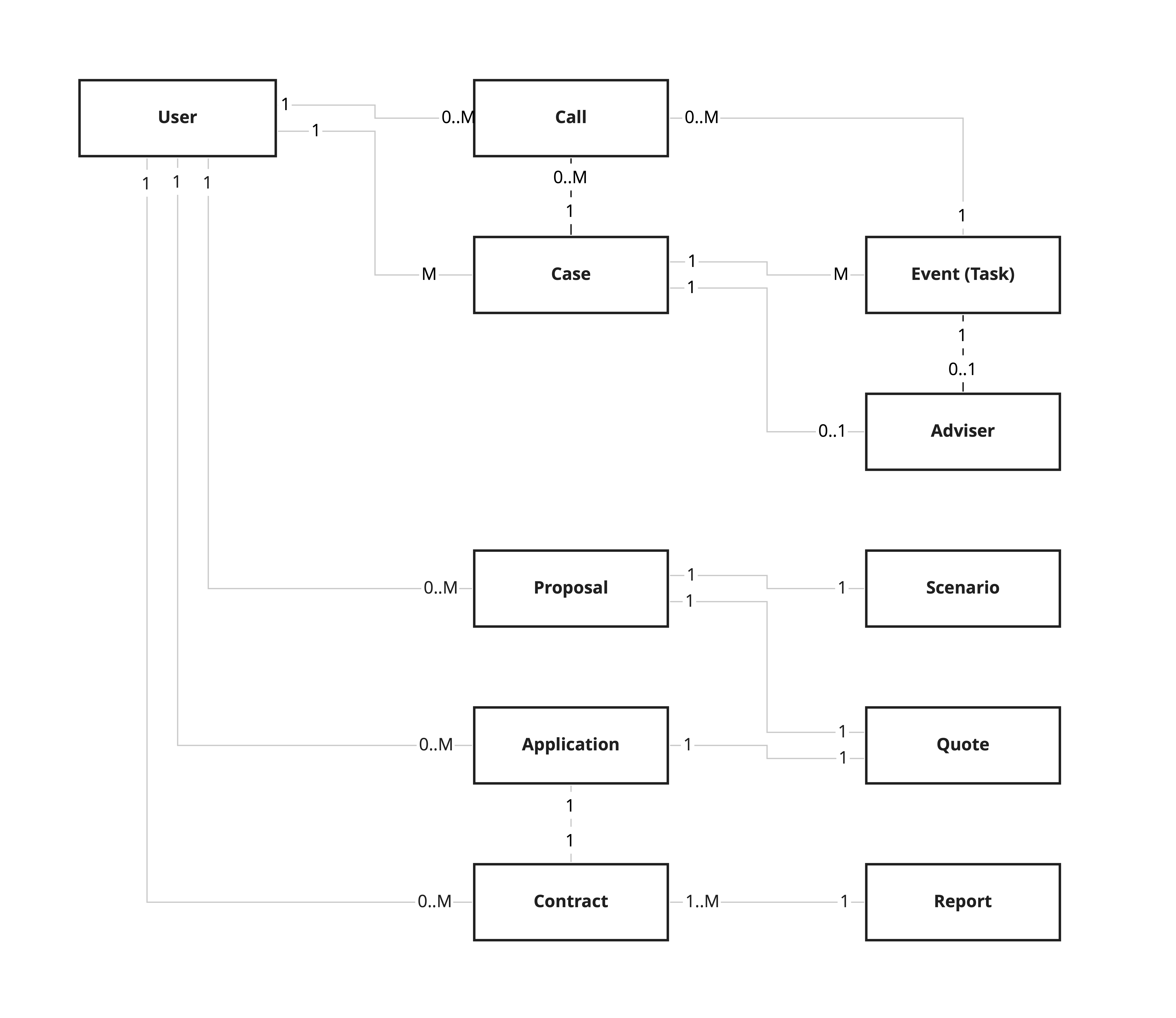

I created an Entity Relationship Diagram in order to have a common reference point during early conversations with the lead engineer prior to designing or building anything.

I co-designed the lead management and case management business rules with the head of sales and lead engineer.

I looked to other industries and products which used cases to manage workflows, such as Salesforce and HubSpot.

Even though we were starting from scratch, I felt we didn't need to reinvent the wheel, so adopted patterns from these industries.

Designing for AI

The AI engine created the ‘perfect’ recommendation, but it wasn't fit for purpose.

The concept was simple.

Use data

science and machine learning to find the life insurance policy most suited to you.

Advice was calculated by:

- gathering data about the user's family, home, income, and finances;

- analysing policy documents from all major insurers; and

- cross-referencing with 3rd party data such as from the ONS.

Key insight

Financial advisers need to be able to explain the AI advice to their clients if they were going to sell it, and buyers often had preferences the algorithms didn’t initially account for.

Product design

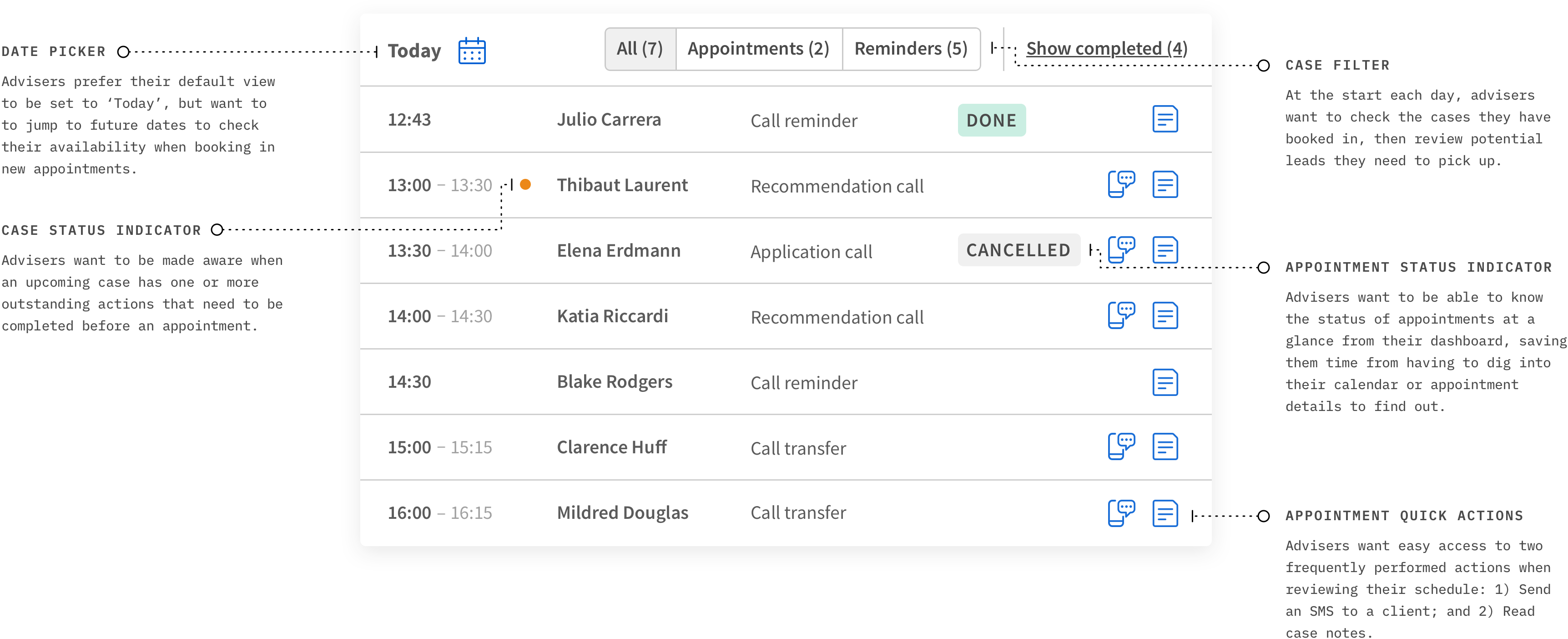

Making the ‘Schedule’ feature work harder as it was most-used in the product

The 'Schedule' was the most frequently used feature of the platform. Advisers would check it at the start of their day, during appointments, in-between appointments, and at the end of the day.

This needed to work much harder than any other feature. Based on contextual research observing and asking about how advisers work, I identified key functionality that would save advisers time and be more effective at servicing their clients.

I tested the Schedule component in Storybook, as well as in our staging and production environments with advisers to ensure it performed as intended.

Product retrospective

Did we help advisers to be more productive? Yes!

Product adoption

9/10

cases

We drastically reduced the number of cases where advisers went ‘off-platform’, only doing so for the most complex cases.

Operational efficiency

133%

cases per day

Advisers were able to work on more cases each day, spend less time on admin and more time with clients. In addition, sales managers were now able to real-time have oversight of the team’s performance.

Case progression

100%

non-standard cases

All clients with health conditions were able get a quote. In addition, advisers were able to research the whole of the market, rather than just the products they were familiar with.

Next steps

Let's chat

Think I might be a good

fit

for your team?

Need temporary support for a project?